All said and done we all have lots to thank Mr. Raju for.

1)It has finally confirmed our belief that governance was never the strong point of many Indian companies

2)It has shaken quite a few companies who innovate when declaring results

3)This time’s quarterly results might be the most accurate EVER and people will desist from painting a rosy picture even when the whole industry is down.

4)Regulators and audit firms will pull up their socks and investors have become more vigilant

5)If none of the above happen in “chalta hai” India , at least the markets are back to reasonable levels where blue chips can be bought

The news channels will keep on showing only news on Satyam and scaring people like you and me but this whole saga will be soon be swept away by the next “breaking news”!

In this all hoopla let’s not forget to look for Value. Many good companies are still available at good valuations and might be for the next 2-3 months. The day the FIIs decide to pump in money the same companies will be over priced within a week or two. Personally I think markets will slowly go down a little further (around 9000 on Sensex) and then take a U turn.

Over all the whole year might not give great returns but if good companies are bought at a correct price you can still get a 30-40% returns as the credit condition improves. With inflation ,oil and interest rates coming down there is more upside than downside left in the market.

Sagas such as the current one shows us why great investors like Mr. Buffet check our the data of more than 10 years of a company before investing in it.

So be at it and keep investing small amounts whenever some great company looks cheap so that in 3-5 years time you are not cursing yourself that you did not invest in 2009.

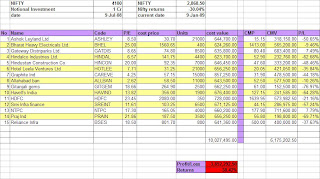

My sample portfolio is still underperforming the nifty by 8%.

No comments:

Post a Comment