I take this opportune moment to explain the limited knowledge that I have of Value investing.

What most people do is speculate and not really invest. Investment should be only done when you find “value”. It applies for all types of investments be it commodities, real estate or equities. You can say that when you get Re 1 for the price of 80 paisa, there is value. On top of this if you can find a margin of safety of 30 paisa more, now that is real value! The wider the difference between the true value (Re 1) and the current market price , the wider is the moat (WB's words)! You do not buy gold at 14K or a 2BHK in the suburbs for 1 Cr or the Sensex at 21K. All this is called speculation, expecting to find a bigger fool to bail you out. As this site is dedicated to equities I will explain a little more in detail on equities. Graham’s book the intelligent investor needs to be read to under the concept in totality. I personally look the following parameters to find out a good company to buy.

1) Low P/E

2) High Cash/Book and low debt

3) Steady growth in EPS

4) Good management

5) Competitive advantage

These parameters need to researched much in advance and should be tracked regularly of the 10-15 companies that you wish to buy (or all listed companies as Buffet does!). Once the data is collected wait for markets to give you the opportunity to buy the Re 1 company at 50 paisa. The current market condition is one of those situations when there is blood on the streets and even 10 year old investments may be at 0% profit. There is plenty of value. Many of us are afraid to invest. The fear is always of the unknown. Do your research and understand the companies and you WILL have the conviction and the confidence to invest.

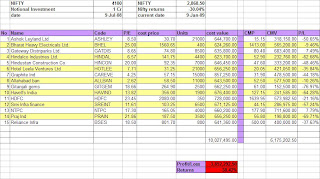

Six months back I had started a dummy portfolio and promised not to change the companies it. It is a general portfolio. I will start another portfolio with just 4 companies and the same amount of investment. Here the difference will be that the companies I pick up should have real value. Over the next 6 months let us see if these companies to better than the randomly selected companies.

Note – Do Not invest without doing your own research.