The markets have not done much in the last 2 months except for moving around in a small range with one downswing. This is the much needed consolidation that is taking place.

This is perfect from a recovery point of view. The result season is over and they were not bad. The markets across the world are showing signs of recovery (with India and China showing the way).

The consolidation is almost over with the markets poised for a move outside the range. There could be a sharp down move if some other country in the developed world goes belly up after the Dubai scare.

From an Indian stock market point of view these would be buying opportunities. Not great buying opportunities like Jan or March but still decent enough for those who missed the last 12 month rally.

I personally am positioned for a move towards 19K on the Sensex and then I might exit many over-valued stocks!

What to buy in these corrections, if any? Blue chips are expensive now and may not really correct in these small corrections. The thing to do is look for value. Some of the middle sized companies are still trading cheap and would be great buys for a holding period of 2-4 years. Even the out of favor Mahindra Satyam could give 100-200% returns in 2 years time with the Upaid case being settled out of court. Many such good companies are available at 1/2 or 1/3 the PE of its industry average.

Most blue chips are now trading at PE of 27-30 and if these cross 40 (like Ashok Leyland) it might be time to exit and sit on some cash. There might be blowout when the PE of these great companied touch 45-47 corresponding to the Sensex level of 21K.

My personal guess would be that we would be making new Sensex highs only in the 2nd half of 2010.

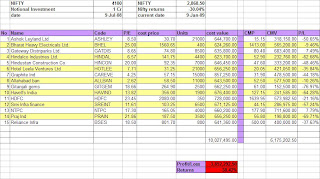

My value picks are beating the Nifty by a whopping 72%!

Merry Christmas to all!